We Help Pre-Retirees Plan for a Comfortable Retirement

Gain Clarity • Achieve Financial Security • Enjoy Life

Don't Step Into Retirement Unprepared!

- Will you have enough money to retire?

- Can you afford the rising cost of healthcare?

- How will a stock market crash impact you?

- Is Social Security necessary for a secure retirement?

- Are you financially and emotionally ready to quit work?

- Should you pay off your mortgage before you retire?

Life can be stressful when you don’t have a plan for your finances. But it doesn’t have to be that way!

Get More From Your Finances with a Custom Plan

Get Specific Recommendations

Get clear action items you can start implementing right away!

Invest with Confidence

Our investment strategy is grounded in historical and analytical research.

Accomplish

Your Goals

No longer be in the dark about which goals you can accomplish.

Enjoy

Life

Have peace of mind knowing that you can enjoy life because you have a plan for your finances.

Why B.E.S.T. Wealth Management?

Access to a CERTIFIED FINANCIAL PLANNER™.

Building financial plans since 2006.

No upfront costs.

Read about Our Agreement to You.

We understand that many people face stress and uncertainty when they don’t have a plan for their finances. Perhaps you don’t have the desire to deal with your finances, don’t have the time to give your finances the proper attention, or don’t know if you’re handling your finances in the best way. Whatever the case, we can help. By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow) so that you can spend your time doing the things you love.

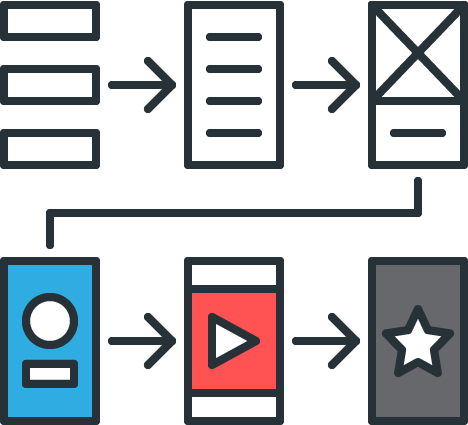

3 Easy Steps to a Comfortable Retirement

Schedule a Meeting

(virtual or in person)

Gather Financial Docs

(with our easy to use guide)

Get a Customized Plan

(with specific recommendations)

Your Concerns

-

Do I Have Enough?

-

Cost of Healthcare

-

Stock Market Crash

-

Viability of Social Security

-

Having a Mortgage

Financial Planning for Pre-Retirees

Retirement is one of the biggest decisions you’ll face in life and it’s important that you plan for it.

Retirement planning doesn’t have to be complicated. Yet most folks find it overwhelming to get started. Even if you already have a plan, you may wonder if you’re on the right track to live the lifestyle you’ve been dreaming about.

You may think retirement planning is just about your investments. However, if you want to enjoy your retirement, you need to consider much more, such as where you’re going to live, how much health care is likely to cost, whether you’ll continue working, and many more things.

Start Planning for Your Financial Future Today

Some advanced planning now helps ensure a comfortable retirement lifestyle while giving you time to course correct if life throws you a curveball.

We understand the challenges and questions that you have as we’ve been helping people prepare for a comfortable retirement since 2006.

By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow).

Schedule a meeting today to start down the road toward financial security and a comfortable retirement!

are you on the

right track?

more about:

-

Planning a Comfortable Retirement

-

Achieving Your Goals

-

Identifying Red Flags

-

Resolving Unanswered Questions

-

Freeing Up Your Time