We Help Widows Pick Up the Financial Pieces

Get Organized • Have Peace of Mind • Be Financially Independent

Did Your Spouse Handle the Finances?

- Do your finances seem scattered now?

- Are you uncertain about where to start?

- Has your retirement plan been disrupted?

- Do you wonder if you're doing things the right way?

- Do you worry about making big financial decisions?

- Are you investing the right way?

Life can be stressful when you don’t have a plan for your finances. We can help pull everything together!

Get More From Your Finances with a Custom Plan

Get Specific Recommendations

Get clear action items you can start implementing right away!

Invest with Confidence

Our investment strategy is grounded in historical and analytical research.

Accomplish

Your Goals

No longer be in the dark about which goals you can accomplish.

Enjoy

Life

Have peace of mind knowing that you can enjoy life because you have a plan for your finances.

Why B.E.S.T. Wealth Management?

Access to a CERTIFIED FINANCIAL PLANNER™.

Building financial plans since 2006.

No upfront costs.

Read about Our Agreement to You.

We understand that many people face stress and uncertainty when they don’t have a plan for their finances. Perhaps you don’t have the desire to deal with your finances, don’t have the time to give your finances the proper attention, or don’t know if you’re handling your finances in the best way. Whatever the case, we can help. By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow) so that you can spend your time doing the things you love.

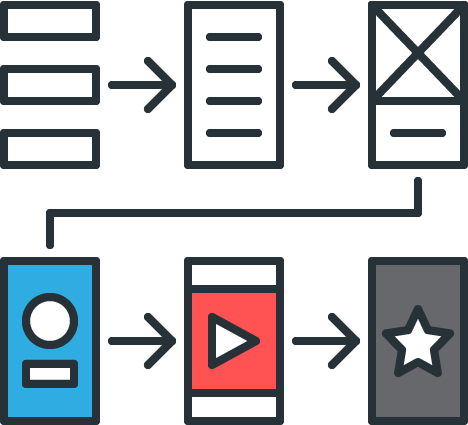

3 Easy Steps to Get Organized

Schedule a Meeting

(virtual or in person)

Gather Financial Docs

(with our easy to use guide)

Get a Customized Plan

(with specific recommendations)

Your Concerns

-

Feeling Overwhelmed

-

Being Disorganized

-

Unsure Where to Start

-

Spouse Handled Finances

-

Making Big Decisions

Financial Planning for Widows

When your spouse dies, you are overwhelmed with grief, fear, loneliness, and uncertainty.

You may be at a loss with what to do about your financial affairs,

especially if your spouse had primary responsibility for financial matters.

The two of you may have talked about the future and kept your affairs well organized. Yet even if your financial knowledge is good, grieving often translates into difficulty making good decisions.

Avoid Major Financial Decisions in the First Year

During your first year as a widow, try to avoid making major changes to your finances. Wait until your mind clears before selling your home, moving, making a big purchase, or changing investments.

Allow yourself to grieve. Wait for some time to pass while you stabilize your situation by focusing on the immediate administrative decisions such as organizing the funeral, notifying insurance companies, contacting social security, and reaching out to an estate-planning attorney.

If you’re overwhelmed by these short-term tasks, a financial planner can quarterback for you by assigning one task to you at a time.

Find a Trusted Advisor Who Provides Unbiased Advice

Look for an advisor who provides unbiased advice and understands the importance of avoiding major financial decisions until you’ve had some time to heal.

B.E.S.T. Wealth Management, LLC will help you take stock of your current situation, prioritize immediate items you need to act on and, when you are ready, develop a financial plan that meets your needs and objectives.

If you’re looking for a plan to help you pick up the financial pieces, then you’re in the right place. We understand what you’re going through as we’ve been helping people with their finances since 2006.

By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow).

Schedule a meeting today to start down the road toward picking up the financial pieces!

Let's Rebuild Your Life Together!

more about:

-

Knowing Where To Start

-

Getting Financially Organized

-

Evaluating Your Retirement

-

Planning For The Future

-

Picking Up the Financial Pieces