We Help Retirees' Savings Last a Lifetime

Gain Clarity • Achieve Financial Security • Enjoy Life

Financial Planning Doesn't Stop at Retirement!

- Is your savings projected to run out?

- Are you investing too aggressively (conservatively)?

- Are you prepared for rising health costs?

- Are you taking advantage of tax savings strategies?

- Can you afford to travel more than you are?

- Are you withdrawing from your investments the right way?

Answers to these questions, and many others, can help to determine if your savings is expected to last your lifetime.

Get More From Your Finances with a Custom Plan

Get Specific Recommendations

Get clear action items you can start implementing right away!

Invest with Confidence

Our investment strategy is grounded in historical and analytical research.

Accomplish

Your Goals

No longer be in the dark about which goals you can accomplish.

Enjoy

Life

Have peace of mind knowing that you can enjoy life because you have a plan for your finances.

Why B.E.S.T. Wealth Management?

Access to a CERTIFIED FINANCIAL PLANNER™.

Building financial plans since 2006.

No upfront costs.

Read about Our Agreement to You.

We understand that many people face stress and uncertainty when they don’t have a plan for their finances. Perhaps you don’t have the desire to deal with your finances, don’t have the time to give your finances the proper attention, or don’t know if you’re handling your finances in the best way. Whatever the case, we can help. By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow) so that you can spend your time doing the things you love.

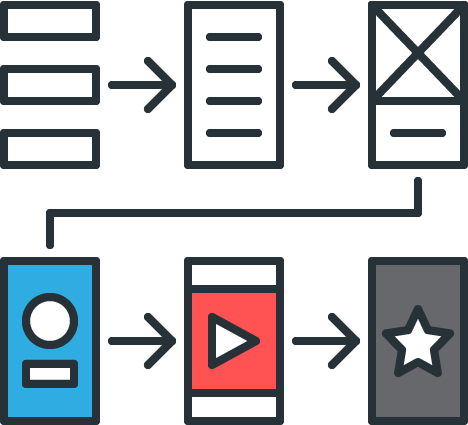

3 Easy Steps to Financial Security

Schedule a Meeting

(virtual or in person)

Gather Financial Docs

(with our easy to use guide)

Get a Customized Plan

(with specific recommendations)

Your Concerns

-

Running Out of Money

-

Affording Travel

-

Rising Health Costs

-

When to Take Social Security

-

Controlling Taxes

-

Leaving a Legacy

Financial Planning Doesn't Stop at Retirement!

Financial Planning for Retirees

Have you been retired for some time? Or did you recently cross the retirement finish line?

You probably think financial planning stops here. But hang on before you do that victory lap. There are a few things to consider from a financial planning perspective.

1. Taking Money Out Can Be Harder Than Putting Money In

Many retirees find that taking money out of their investment portfolio is actually a lot more complicated than putting money in. You may be juggling multiple income sources and looking for advice on how to withdraw funds tax-efficiently.

The decisions you make here could be the difference between running out of money or not! In other words, there’s more risk at this stage of investing than there was when you were accumulating money.

2. Optimize Your Asset Allocation

As you get older, you’ll probably want to change your asset allocation. Simply put, you’ll want to make sure your investments have the right amount in stocks, bonds, and cash to minimize your risk.

Now that you’re retired, you want to preserve your capital—so emphasizing lower risk investments in your portfolio may make sense. Yet, you may find yourself with 30+ years in retirement so you also need your money to grow. Balancing safety and growth is vitally important as a retiree.

3. Review Your Insurance Needs

Your insurance needs are likely changing, too. With fewer debts and dependents, you likely won’t need as much life insurance, if any at all. In addition, you need to plan to protect yourself from rising health care costs along with future long-term care needs. Proper planning around insurance is necessary to protect your investments, your lifestyle, and your spouse.

4. Fine Tune Your Plan

Every year of your retirement will be different. You’ll likely need to make annual adjustments to your financial plan to ensure you maintain a successful and satisfying lifestyle. It’s always better to identify things that need to be changed sooner rather than later, which is why regular reviews are so important.

Enjoy Peace of Mind in Your Retirement

Just when you thought your financial worries were behind you, you have new questions in retirement. We understand the issues and concerns you face as we’ve been helping retirees with their financial planning since 2006.

By working with us, you’ll free up your time and have a plan for your finances (with specific steps to follow).

Schedule a meeting today to help ensure your savings will last a lifetime and possibly into the next generation!

Improve Your Plan!

more about:

-

Preserving Your Savings

-

Reviewing Your Plan

-

Making Adjustments

-

Spending More Time With Grandkids