As a business owner you have a tremendous opportunity that your employees do not have. You have the ability to set up a 401k plan.

Employees don’t have a say in what type of retirement plan, if any, their company offers.

But for you, as a small business owner, you get to choose whether or not to implement a 401k plan (or some other type of plan). And you get to choose how to set this plan up which can dramatically impact the amount of money you are able to save and shelter from taxes.

In my last blog, Should You Set Up A Small Business 401k, I discussed how a business owner can use a retirement plan, such as a 401k, to fund their personal retirement.

But today, before I discuss the benefits of setting up a 401k, I want to address a thought that many small business owners have:

“I CAN’T AFFORD TO SET UP A 401K PLAN!”

If your company is not profitable then I agree with you. But if you have profit then a 401k plan should be on your radar screen.

WHY A PROFITABLE COMPANY SHOULD STRONGLY CONSIDER A 401K PLAN.

Having a 401k plan at your company vs. not having one at all provides you with the opportunity to put more money in your pocket and also minimize taxes.

Let me walk you through an example.

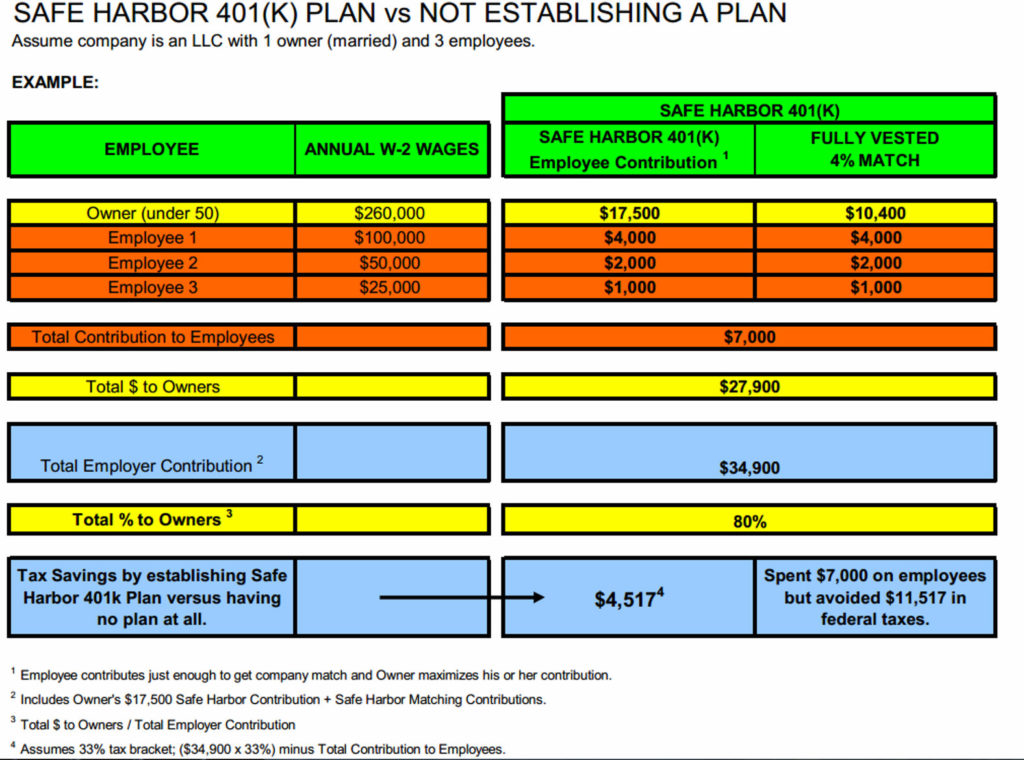

Before I get started with the explanation, be sure to view the chart below which will help you to visually understand what I’m about to say.

Let’s assume that your company is an S-Corp or an LLC (taxed as an S-Corp), you are the only owner, and you have 3 employees. As the Owner, your salary is $260,000. Employee 1 has a salary of $100,000. Employee 2 $50,000. And Employee 3 $25,000.

You contribute the maximum that you’re eligible ($17,500 – based on 2014 regulations; amount is $18,000 for 2015) to the 401k. Your employees each contribute just enough to get the company match (4% of their salary). As a side note, in case you don’t know, the type of 401k we are discussing is one in which the employer must match employees’ contributions up to 4% of their salary. It’s called a Safe Harbor 401k.

As you can see in the chart, the company’s total contribution to employees is $7,000 (company match representing 4% of their salaries) and the total contribution to yourself is $27,900 ($17,500 personal contribution + $10,400 company match) resulting in a grand total contribution of $34,900.

Although this amount of money would validate a business owner’s concern that they can’t afford a 401k plan, a little more analysis will reveal that these contributions actually served to minimize taxes and put more money in the owner’s pocket.

WITHOUT A 401K

If the $34,900 in contributions were not invested in your or your employees’ 401k then it would have been taxed. Since the example assumes you make $260,000 / year, this places you in the 33% federal tax bracket and means that you would have paid $11,517 in taxes ($34,900 x 33%) if a 401k wasn’t in place.

WITH A 401K

However, since you did make contributions totaling $34,900 to your and your employees’ 401k, this money gets to avoid 33% in taxes. Plus with a 401k, the only true out of pocket cost you have is the $7,000 contributed by the company to the employees’ accounts (the money you contributed to your own 401k is not really an out of pocket cost since you get to keep it).

So, to put this in perspective:

YOU SPENT $7,000 ON YOUR EMPLOYEES YET AVOIDED $11,517 IN TAXES.

The difference represents a true bottom line savings of $4,517 by having a 401k versus not having one at all.

And to top it all off, the savings would likely be even greater considering that I didn’t even discuss the potential avoidance of self employment and state income taxes. Note that self employment tax would only be avoided if you were a sole proprietor or an LLC (taxed as a sole proprietor).

BUT I DON’T MAKE ANYWHERE NEAR $260,000 / YEAR.

Perhaps you’re thinking that all of this sounds good, but as a business owner, you don’t pay yourself anywhere near $260,000 per year. Plus you don’t even have the ability to save the full $17,500 to your 401k.

Let’s instead assume that you pay yourself a lesser salary of $100,000 and you are only able to contribute half as much to your 401k ($8,750). In this scenario, there really isn’t any tax savings from a federal and state tax standpoint (it would cost you $7,000 just to save around $6,000 in taxes).

Although mathematically you would be losing money in this scenario the 401k that you put in place would serve to attract and retain quality employees. So there is a benefit from that perspective. Plus, if you were able to increase your own 401k contributions from $8,750 to $12,500 you would break even (spend $7,000 on employee match but save about $7,000 in taxes).

BENEFITS OF SETTING UP A 401K

It’s true that the tax savings are more prevalent as your salary and 401k contributions increase, but as you can see, a 401k plan is a good way for profitable companies to minimize taxes (secret benefit #1) and put more money in the pockets of owners (secret benefit #2).

An added benefit of setting up a 401k is that you provide your employees with a benefit they’ve come to expect (secret benefit #3). After all, if you don’t provide it your competition will and you may lose valuable / trusted employees.

And if all of that isn’t enough, you may be able to take advantage of a $500 business tax credit (secret benefit #4) for 3 years just for establishing a 401k plan. This means even more tax savings.

It doesn’t always work out to where you will save money by implementing a 401k for your company, but under the right circumstances you could come out ahead.

If you’d like some help determining whether or not a 401k is right for your company then feel free to contact us or check out the Company Sponsored Retirement Plan section of our website for more information.

If you are a one owner company with no employees, a husband and wife team with no employees, or a 1099 contractor, then stay tuned to learn about a special type of 401k plan that was especially created for you.

If you don’t want to miss the next blog post, then sign up to receive our eContent.

Brad E.S. Tinnon

CERTIFIED FINANCIAL PLANNER™

P.S. I know there are several moving parts here, so feel free to ask any questions you may have or leave any comments that are on your mind. Thanks for tuning in.

Photo courtesy of 401(K) 2012